Lithium-ion batteries probably have cars locked up, but what about grid storage?

Welcome back to Battery Week — where we use the term “week” somewhat loosely.

Up until now, we’ve been focusing on lithium-on batteries (LIBs) — why they are so important, how they work, and the varieties of LIBs that are battling it out for the biggest battery market, electric vehicles (EVs).

It’s fairly clear from that discussion that LIBs, in some incarnation, are going to dominate EVs for a long while to come. There is no other commercial battery that can pack as much power into as small a space and lightweight a package. Plus, LIBs have built up a large manufacturing base, driving down prices with scale and industry experience. Their lock on the EV market is likely unbreakable, at least for the foreseeable future.

But there’s another battery market where some competitors hope to get a foothold: grid storage. They think there’s space in that market waiting to be claimed.

Zinc batteries

Several companies are working on batteries that exchange zinc ions instead of lithium ions — it’s the second-most-popular metal for batteries.

Zinc has the particular advantage of being light and energy-dense like lithium, so with relatively modest adjustments, it can slipstream into the lithium-ion manufacturing process.

Zinc is plentiful, cheaper than lithium, largely benign, and makes batteries that are easier to recycle. Like other lithium alternatives, zinc sacrifices energy density, but makes some of it back up in savings on safety systems at the battery-pack level, thanks to the lack of any need for fire suppression. This puts it in the same markets as lithium iron phosphate (LFP): smaller commuter/city vehicles, robo-taxis, scooters, e-bikes — and energy storage.

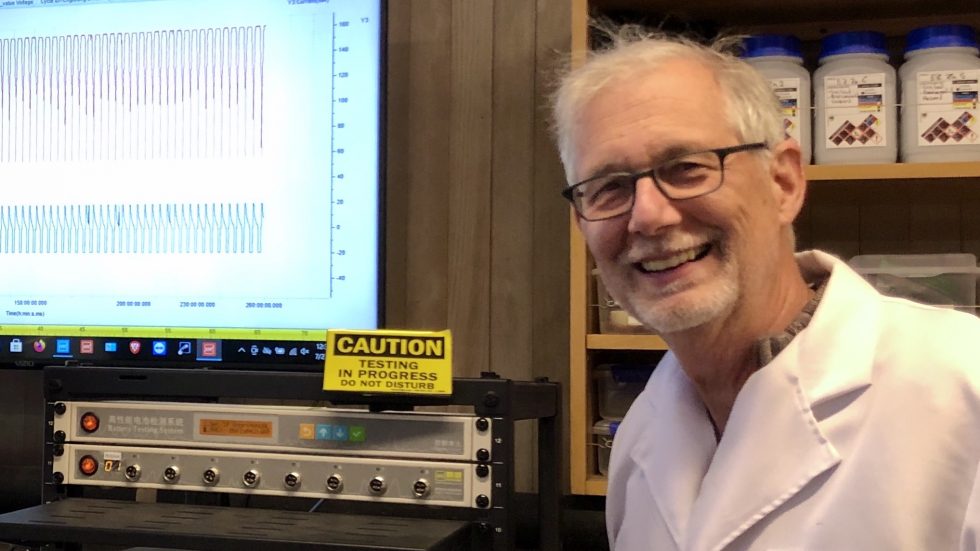

Some in the zinc crew have more ambitious designs: “We think we can coexist with lithium-ion and replace lead acid,” says Michael Burz, president and CEO of EnZinc, which has developed a new zinc anode it says can come close to LIBs on energy density. Remember, lead-acid batteries are still ubiquitous. “Forklifts use them. Airplanes. Snowmobiles,” says Burz. “Data centers have huge banks of lead-acid batteries they use for switchover power.” The technology still has a $45 billion global market.

EnZinc thinks it can hit a sweet spot: close to the energy density of LIBs, close to the low cost of lead-acid, safer than either, and good enough to substitute for a big chunk of both.

Zinc anodes are “cathode-agnostic,” so Burz envisions his company becoming an anode supplier, rather than a battery manufacturer, with “Zinc Inside” labels modeled on the “Intel Inside” processor designation. Research is underway on a number of cathodes, from manganese and nickel to — just as with lithium — air. A zinc-air battery “has a system-level specific energy of anywhere between 250 to 350 watt-hours per kilogram,” says Burz, a level well above most LIBs. The trick is making it controllable and rechargeable. There are zinc-air battery companies offering commercial products that claim they’ve solved those problems, such as NantEnergy (formerly Fluidic), which is targeting its zinc-air batteries at off-grid markets in developing countries.