Enzinc CEO: Zinc-Based Batteries are ‘Better, From the Ground Up’

A glance at any energy analyst’s predictions shows demand for batteries is strong and only getting stronger as the energy and transportation industries embrace decarbonisation. And while the industry may feel well established to those who have been working in it for the past decade, it’s still relatively early days when it comes to influencing the mix of batteries deployed.

The battery industry can derisk this coming wave of demand by ensuring that it meets the needs with a diversity of technologies.

The energy storage industry only needs to look as far as the solar industry to see why it’s unwise to tie a fast-growing industry to a single input or region. More than half of the key ingredient for solar panels, polysilicon, comes from one province of China.

Not only has it meant that the country producing it, China, is getting first dibs on the volume produced, but also it opened the rest of the industry to political risk as evidence of human rights abuses in China’s Xinjiang Province mount and supply chain risk as trade tensions wax and wane.

Even in established industries, lack of diversification harms markets. The recent disruption to global fossil fuel markets has reminded governments and consumers alike of the power wielded by OPEC members, which control 60% of all petroleum exports. It’s a lesson gasoline-powered car drivers have revisited many times since the 1970s oil shortages.

Today, lithium-based batteries dominate the emerging energy storage markets, from EVs to home energy storage, to utility-scale batteries.

While the industry’s nascent, it doesn’t seem problematic. However, as the industry matures, today’s concentration will seem shortsighted. Why? Because the rapidly rising demand for batteries means growth may be stymied by a lack of supply of lithium globally if we don’t diversify now.

Could zinc batteries usurp lithium-ion’s strong market position and become the storage technology of choice?

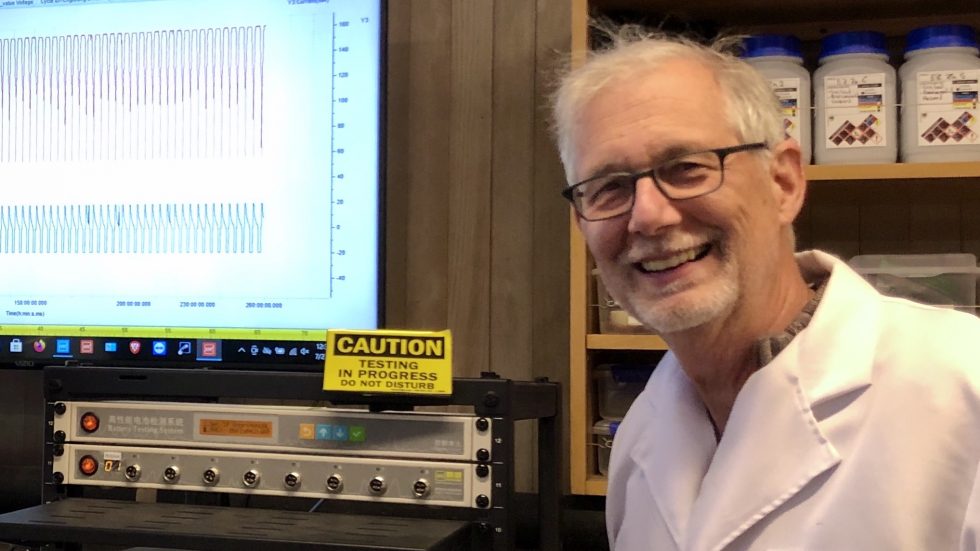

The potential certainly exists and Enzinc CEO Michael Burz is on a mission to make it happen.

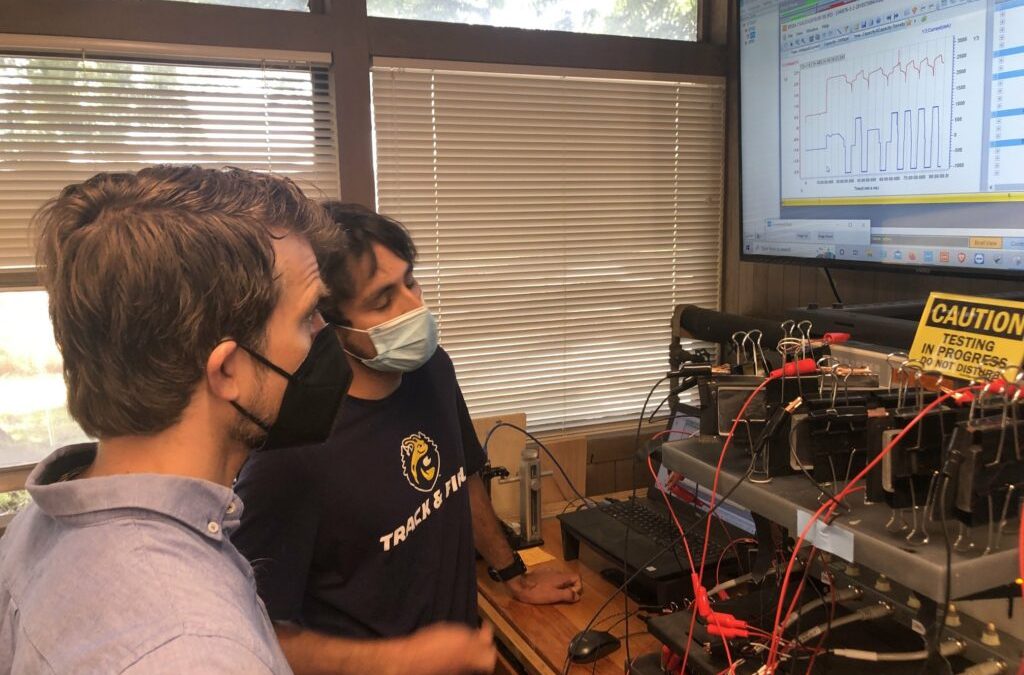

Headquartered at the University of California in Berkeley’s Richmond Field Station in the San Francisco Bay area, Enzinc’s engineering team has developed a sponge-type anode technology made from zinc, and says it will be the first company offering a rechargeable zinc-based battery that can compete with lithium-ion.

Enzinc created the anode using technology developed by the US Naval Research Laboratory. So far, Enzinc has raised north of $1.3m, mainly in the form of grants from the US Department of Energy and the California Energy Commission, as well as investments made by founders, senior advisors and angel investors.

The company recently completed 1,000 cycles of its test anode and is beginning to scale the technology into a small battery for commercial testing, which is scheduled to take place in the second quarter of next year

Welcome back to Battery Week — where we use the term “week” somewhat loosely.

Up until now, we’ve been focusing on lithium-on batteries (LIBs) — why they are so important, how they work, and the varieties of LIBs that are battling it out for the biggest battery market, electric vehicles (EVs).

It’s fairly clear from that discussion that LIBs, in some incarnation, are going to dominate EVs for a long while to come. There is no other commercial battery that can pack as much power into as small a space and lightweight a package. Plus, LIBs have built up a large manufacturing base, driving down prices with scale and industry experience. Their lock on the EV market is likely unbreakable, at least for the foreseeable future.

But there’s another battery market where some competitors hope to get a foothold: grid storage. They think there’s space in that market waiting to be claimed.

Several companies are working on batteries that exchange zinc ions instead of lithium ions — it’s the second-most-popular metal for batteries.

Zinc has the particular advantage of being light and energy-dense like lithium, so with relatively modest adjustments, it can slipstream into the lithium-ion manufacturing process.

Zinc is plentiful, cheaper than lithium, largely benign, and makes batteries that are easier to recycle. Like other lithium alternatives, zinc sacrifices energy density, but makes some of it back up in savings on safety systems at the battery-pack level, thanks to the lack of any need for fire suppression. This puts it in the same markets as lithium iron phosphate (LFP): smaller commuter/city vehicles, robo-taxis, scooters, e-bikes — and energy storage.

Some in the zinc crew have more ambitious designs: “We think we can coexist with lithium-ion and replace lead acid,” says Michael Burz, president and CEO of EnZinc, which has developed a new zinc anode it says can come close to LIBs on energy density. Remember, lead-acid batteries are still ubiquitous. “Forklifts use them. Airplanes. Snowmobiles,” says Burz. “Data centers have huge banks of lead-acid batteries they use for switchover power.” The technology still has a $45 billion global market.

EnZinc thinks it can hit a sweet spot: close to the energy density of LIBs, close to the low cost of lead-acid, safer than either, and good enough to substitute for a big chunk of both.

Zinc anodes are “cathode-agnostic,” so Burz envisions his company becoming an anode supplier, rather than a battery manufacturer, with “Zinc Inside” labels modeled on the “Intel Inside” processor designation. Research is underway on a number of cathodes, from manganese and nickel to — just as with lithium — air. A zinc-air battery “has a system-level specific energy of anywhere between 250 to 350 watt-hours per kilogram,” says Burz, a level well above most LIBs. The trick is making it controllable and rechargeable. There are zinc-air battery companies offering commercial products that claim they’ve solved those problems, such as NantEnergy (formerly Fluidic), which is targeting its zinc-air batteries at off-grid markets in developing countries.